Currently Empty: NT$0

How to Open a Forex Trading Account: A Comprehensive Guide

Forex trading has grown remarkably popular, providing opportunities for individuals to trade currencies and potentially profit from the fluctuations in exchange rates. If you’re considering stepping into the world of Forex trading, the first essential step is to open forex trading account Trading Brokers in Pakistan. In this guide, we’ll walk you through the process, explore various account types, what to look for in a broker, and tips to help you get started effectively.

Understanding Forex Trading Accounts

A Forex trading account is a type of account that allows you to trade in the foreign exchange market. Similar to regular bank accounts, Forex accounts come in different types, each catering to different trading needs and levels of experience.

Types of Forex Trading Accounts

There are several types of Forex trading accounts you can choose from based on your trading style, objectives, and experience level:

- Demo Account: A practice account that allows you to trade with virtual funds. It’s ideal for beginners to understand how trading works without risking real money.

- Standard Account: This account type is suitable for experienced traders and typically requires a higher minimum deposit. It allows for larger trades and may offer higher leverage.

- Mini Account: This account is designed for traders who prefer smaller trades with lower minimum deposits. Ideal for novice traders looking to gain experience.

- VIP/Professional Account: Tailored for high-volume traders, this account type offers personalized services, lower spreads, and advanced trading tools.

Choosing a Forex Broker

Your choice of broker is critical in your Forex trading journey. A reputable broker can offer a smooth trading experience, while a less reliable one can hinder your trading success. Here’s what to consider when choosing a Forex broker:

- Regulation: Ensure the broker is regulated by a recognized financial authority. This adds a layer of security and oversight to your trading.

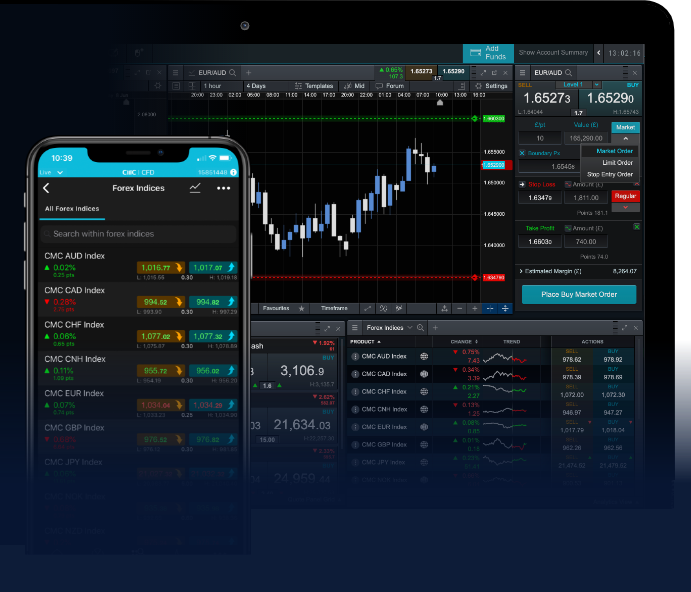

- Trading Platforms: The platform you use can significantly affect your trading experience. Look for user-friendly interfaces and essential tools for analysis.

- Spreads and Commissions: Compare the spreads and commission fees among brokers to determine which offers the best pricing structure for your trading style.

- Customer Support: Reliable customer support is essential, especially for new traders who may need assistance at any moment.

- Account Types: Ensure the broker offers a variety of account types that suit your trading needs and experience level.

Steps to Open a Forex Trading Account

Once you’ve found a suitable broker, opening a Forex trading account generally involves the following steps:

1. Choose the Account Type

Determine which type of account fits your trading style and risk tolerance.

2. Complete the Application Form

Fill out the broker’s application form with personal information, including your name, contact details, and proof of identity. Many brokers will require documents like a government-issued ID and a utility bill for verification purposes.

3. Fund Your Account

Your account needs to be funded before you can start trading. Most brokers accept various deposit methods, including bank transfers, credit/debit cards, and e-wallets. Always consider any deposit minimums set by the broker.

4. Download the Trading Platform

Once your account is approved and funded, download the broker’s trading platform. Most brokers offer platforms like MetaTrader 4 or 5, which are popular among traders for their advanced charts and indicators.

5. Start Trading

With your account set up, you can begin trading. Start by practicing with a demo account to familiarize yourself with the platform before committing real funds.

Best Practices for Forex Trading

Now that you have your account set up and ready, here are some best practices to keep in mind as you start trading:

- Educate Yourself: Continuously learn about Forex trading strategies, technical analysis, and market trends. Knowledge is power in trading.

- Use Risk Management: Implement risk management strategies, such as setting stop-loss orders and never risking more than a small percentage of your account on a single trade.

- Stay Informed: Keep up with global economic news and events that can impact currency values, as Forex trading is greatly influenced by economic indicators.

- Keep Emotions in Check: Trading can be emotional, but it’s essential to maintain a calm mindset. Avoid making impulsive decisions based on fear or greed.

Conclusion

Opening a Forex trading account is a simple but crucial step towards entering the world of Forex trading. By selecting a reputable broker, understanding the different types of accounts available, and adhering to best practices, you’ll build a solid foundation for your trading journey. Remember to continuously educate yourself and adapt your strategies according to your trading style and the market conditions. Happy trading!